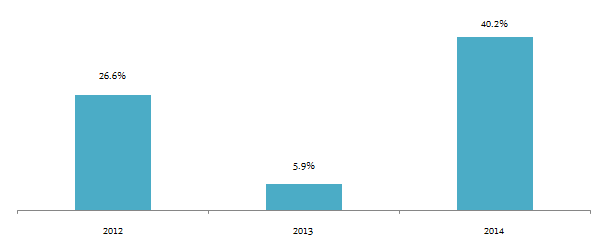

Balanced Funds are equity oriented hybrid funds. These funds usually invest about 70% of their portfolio in equity and 30% in debt. Some funds may have a higher allocation to debt. But the debt allocation is not more than 35%, because if the debt allocation is more than 35% then the fund is classified as a debt fund for tax purposes. The debt component reduces the risk of these funds considerably compared to purely equity oriented funds. The average balanced fund returns in 2014 was around 40%, higher than the average 2014 returns of large cap funds category. How did balanced funds give such high returns, despite the significant debt component in their portfolio? The fund managers took smart duration calls in their debt portfolio. Consequently, even the debt portion of balanced fund portfolios gave high returns. The chart below shows the annual returns of balanced funds from 2012 to 2014.