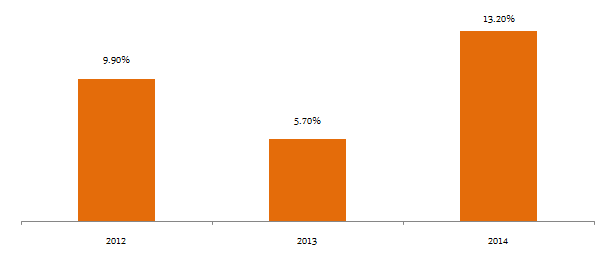

Income funds invest in long duration government and corporate bonds. These funds carry significant interest rate risk. Therefore, it is suitable for investors with longer time horizon and higher risk tolerance. Investors need to time their entry and exit, into and from these funds to get the maximum returns. Income funds are suitable when the interest rates are peaking, so that investors can benefit from the accrual of higher yields and also the capital appreciation of the bonds, when interest rates decline. The average return of income funds in 2014 was 13.2%, benefitting from the moderation of 10 year G-sec yields. The chart below shows the annual returns of income funds from 2012 to 2014.