A bonus issue is a stock dividend, declared by a company to reward the shareholders. The bonus shares are issued out of the reserves of the company. In simple terms, these are free shares that the stockholders receive against the shares that they currently hold. These allocations typically come in a fixed ratio such as 1:1, 2:1, 3:1, etc.

For example, if the Nestle declares bonus in the ratio of 2:1 ratio, the existing shareholders, will get two additional shares for every one share they hold at no extra cost. So if you own 100 shares of Nestle, then you will be issued an additional 200 shares, and your total holding will become 300 shares.

After the announcement of a bonus issue, a record date is decided for the issue. To be entitled for the bonus, shareholders should have their stakes on that particular date. Investors purchasing shares after that are not entitled for the bonus shares.

After the record date, comes ex-date. The price alteration happens during ex-date. Those who invested during this phase are not entitled to the bonus shares.

After the declaration of the bonus but before the record date, the shares are called as cum-bonus. After the record date, when the bonus has been given, the shares are called ex-bonus.

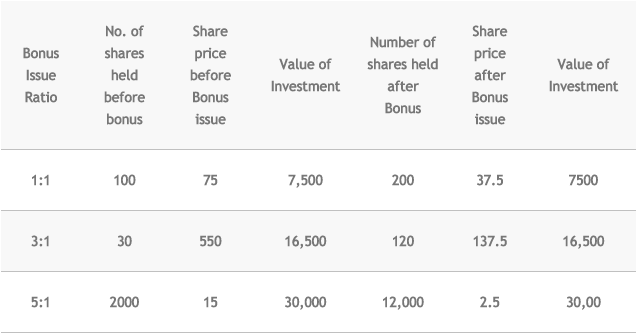

Following table will help you understand the concept better. Let us consider a bonus issue on different ratios – 1:1, 3:1 and 5:1.

Following are the reasons for companies to give bonus share :

Following are the reasons for companies to give bonus share :

- To reward their stockholders-

The Company pays gratitude to its investors in the form of giving a bonus share. Company usually gains the confidence of the investors by issuing bonus shares.

- To encourage retail investors participation –

Companies issue bonus shares to encourage retail investors participation, particularly when the price per share of a company is very high, and it becomes difficult for retail investors to buy shares. By issuing bonus shares, the number of shares increases, but the price of each share decreases as shown in the table above.

Note:

It is important to note that when the bonus shares are issued, only the number of shares the stockholder holds will increase but the overall value of an investment will remain the same. Bonus issue increases only the total shares of a company and not the value.

Suppose, originally the total share is ten lakhs. After the issue of 1:1 bonus, the number of shares increases up to 20 Lakhs. However, the total market value remains the same. As we can see in the above table, If previously any stock is trading at Rs-200, then after 1:1 bonus issue, the stock price will adjust to Rs-100. The price adjustment in the stock price occurs accordingly.